Nvidia has once again impressed Wall Street with its latest financial results, solidifying its position as a top player in the technology industry. The company reported a staggering $26 billion in revenue for the first quarter of 2024, marking an 18% increase from the previous quarter and a remarkable 262% increase from a year ago. These impressive numbers were largely driven by the success of its data center business and the growing demand for AI technology. In fact, $22.6 billion of the total revenue came from this sector, showcasing the company’s dominance in the market. As a result, Nvidia’s shares soared to over $1,000 in after-hours trading, making it the world’s third-largest company by market cap.

Jensen Huang’s Optimism

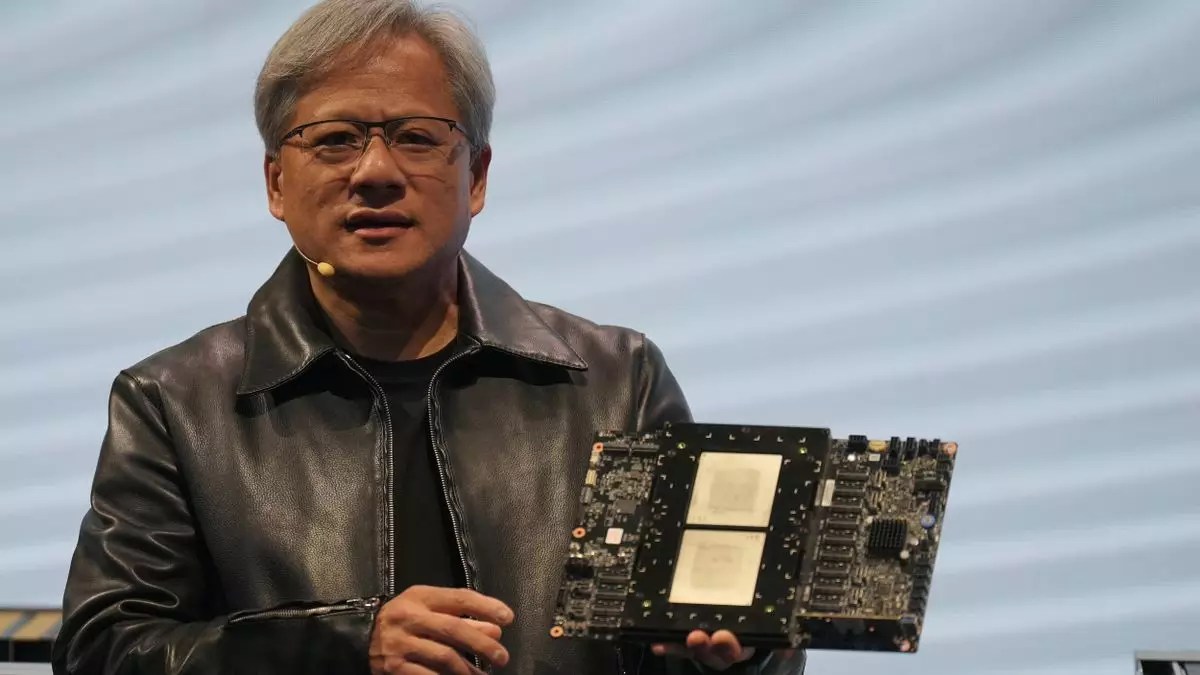

Nvidia’s CEO, Jensen Huang, expressed his optimism about the company’s future during the earnings call. He emphasized the shift towards accelerated computing and the rise of AI factories, which he believes will revolutionize various industries and drive productivity gains. Huang’s vision for Nvidia as a key player in the AI space paints a bright future for the company, and investors have responded positively to his strategic direction.

Gaming Graphics Cards Business

While Nvidia’s data center and AI businesses have been driving its financial success, its gaming graphics cards division has experienced more modest growth. With a revenue of $2.6 billion, this sector saw an 8% decline from the previous quarter but an 18% increase from a year ago. The dip in revenue can be attributed to the lull in demand following the holiday season and the absence of a new GPU family. However, the upcoming release of Nvidia’s Blackwell graphics cards could potentially boost the gaming division’s financial performance in the coming quarters.

In a surprising move, Nvidia announced a 10-to-1 stock split, which will dilute the value of every share to a tenth of its original price. While this may not have a significant impact on the company’s overall valuation, it could impact investor perception and accessibility to Nvidia’s shares. Despite this announcement, Nvidia’s short-term success seems promising, especially with the continued demand for AI technology driving its revenue growth.

As Nvidia looks ahead to the future, the company will be banking on its next-generation Blackwell AI chips and systems to drive its future earnings reports. However, the volatile nature of the market and the high expectations set by Wall Street present a challenge for Nvidia to maintain its momentum. While the company’s recent financial success is laudable, sustaining this level of performance will require continued innovation and strategic business decisions.

Nvidia’s recent financial results have solidified its position as a key player in the technology industry. With a focus on data center and AI technology, along with upcoming releases in the gaming sector, Nvidia is poised for continued success in the market. However, the company will need to navigate the ever-changing landscape of the industry and meet the high expectations of investors to maintain its position as a technology powerhouse.

Leave a Reply