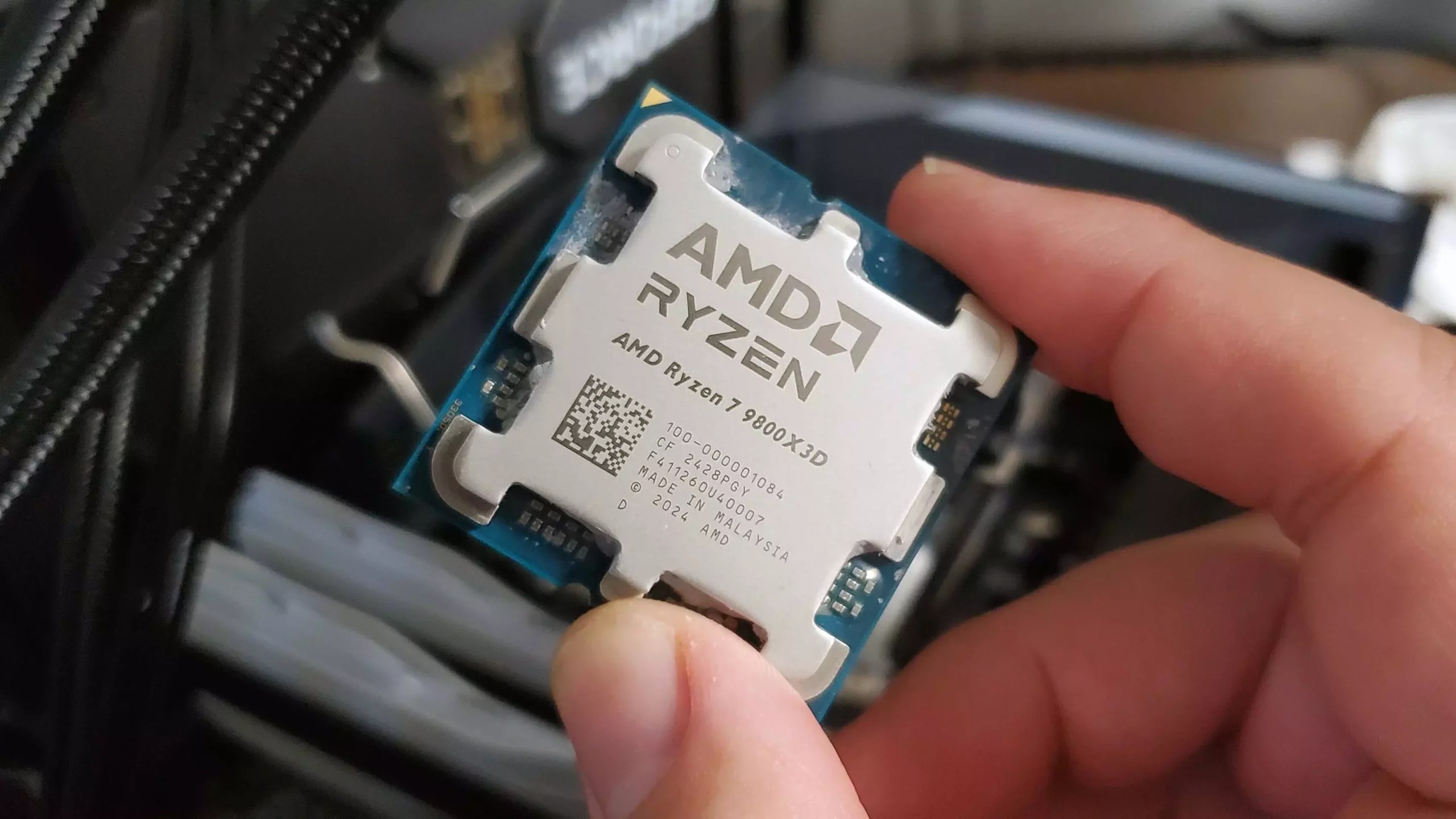

In recent years, AMD has emerged from the shadows of its larger competitors to establish itself as a formidable force in the semiconductor industry. The company’s latest financial report underscores this transformation, revealing a staggering 69% increase in revenue within its Client and Gaming divisions. Such growth is not merely a statistical blip but a testament to AMD’s strategic positioning and product innovation. High-performance Ryzen CPUs like the 7800X, alongside a resurgence in Radeon graphics card sales—especially among PC gamers and system builders—has invigorated AMD’s bottom line.

The preference shift among consumers and OEMs, partly driven by dissatisfaction with Intel’s stagnant Raptor Lake lineup and the underwhelming response to Intel’s Arrow Lake, has created a near-perfect window of opportunity. AMD’s chips, with their innovative chiplet architecture and competitive pricing, have become the go-to alternative. This trend is further bolstered by the increasing demand for gaming systems and semi-custom solutions, notably in collaborations with companies like Dell. AMD’s ability to capture a significant share of this market demonstrates a savvy understanding of contemporary consumer preferences and a willingness to capitalize on the perceived shortcomings of competitors.

Strategic Gains, Not Without Its Hurdles

While AMD’s consumer divisions shine brightly, the company’s data center segment illustrates a more nuanced picture. On one hand, a 14% year-over-year revenue boost indicates rising interest in AMD’s server-grade hardware. Yet, this sector also signals caution; a particularly sharp operating loss of $155 million reveals the complexity of navigating global trade restrictions and geopolitical hurdles. Specifically, US export restrictions on MI308 GPUs served as a formidable barrier, forcing AMD to record approximately $800 million in inventory and related charges. These restrictions highlight the fragility of AMD’s ambitions in the lucrative AI and data center markets, which are increasingly vital to its growth strategy.

Despite the revenue growth, the data center losses serve as a reminder of the volatile landscape the company operates within. Larger competitors like Nvidia dominate the sector, with their data center revenues far surpassing AMD’s, making AMD’s rise more akin to a sustained push rather than a sprint. Yet, AMD’s leadership remains optimistic, projecting a revenue of $8.6 billion for Q3, fueled by expectations of regulatory clearance to resume AI chip sales in China. This potential return could catalyze substantial financial gains, enabling AMD to challenge the existing giants more robustly.

Market Sentiment and Future Outlook

Short-term market reactions have been mixed; despite impressive growth, AMD’s stock experienced a slight dip following the earnings release. The dip largely reflects investor concerns over the relatively modest data center revenue gains and the hefty charges linked to export restrictions. Nonetheless, AMD’s leadership displays unwavering confidence, emphasizing their strategic focus on innovation and market expansion.

Looking forward, AMD’s prospects look promising, particularly if regulatory hurdles clear. The company’s ability to leverage emerging markets, expand its AI chip offerings, and capitalize on weaker competitors’ struggles could position it for sustained success. However, it is crucial for AMD to address its operational challenges in the data center segment and maintain its competitive edge in a rapidly evolving industry landscape.

Ultimately, AMD’s recent performance encapsulates a narrative of strategic growth bolstered by innovative products and market dynamics, tempered by geopolitical and market-specific hurdles. How it navigates these obstacles will determine whether this ascent is sustained or if short-term gains become fleeting. But for now, AMD stands as a resilient and ambitious challenger poised to reshape the future of computing and AI-driven technology.

Leave a Reply